$1trn Economy: Banks To Raise Capital Base – CBN Governor

By Ibrahim Umar

Kanempress

25th November 2023

The Central Bank of Nigeria (CBN), says that banks in the country would be asked to raise their capital base to support the $1trillion economy of the government.

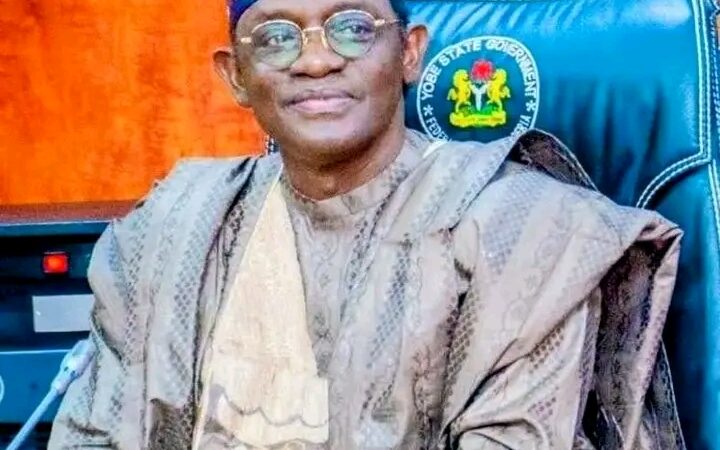

The governor of the apex bank, Yemi Cardoso, disclosed this to Kanempress in Lagos at the 58th Annual Bankers Dinner and Grand Finale of the 60th anniversary of the Chartered Institute of Bankers of Nigeria (CIBN).

Cardoso said Nigerian banks did not have sufficient capital relative to the financial system’s needs in servicing a $1.0trn economy in the near future.

Nigerian President Bola Tinubu had recently hinted that the economy could grow to $1trn by 2026 and a $3trn Nigerian economy in 10 years.

‘The Origin: Madam Koi Koi’ becomes Nigeria’s most-watched Netflix series

Uzoho, other keepers who crushed hopes of Nigerians

“It is not just about the stability of the financial system in the present moment as we have already established that the current assessment showed stability. However, we need to ask ourselves: Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1.0trn economy in the near future? In my opinion, the answer is “no!” unless we take action. Therefore, we must make difficult decisions regarding capital adequacy. As a first step we will be directing banks to increase their capital,” Cardoso said.

The Apex Bank boss, who bemoaned the foreign exchange restrictions hitherto placed on the importation of 43 items by the previous government, said the CBN under his watch would be repositioned as a catalyst for change and economic development.

Applauding the CIBN, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said the Bola Tinubu-led government was committed to building a stable and resilient economy.

Edun said the decisions taken by the government were difficult but necessary in turning Nigeria around, attracting investment, creating jobs and reducing poverty.

The chairman of the Body of Banks’ Chief Executive Officers and managing director, Zenith Bank, Mr Ebenezer Onyeagwu, called for the support of the reforms introduced by the Apex Bank.

He said that the apex bank was already tackling the issue of FX forward and it would soon be a thing of the past.

“Though some of the reforms are painful, we wholly support them because we need to endure the pain today for a brighter future,” Onyeagwu said.

The president of the Chartered Institute of Bankers of Nigeria, Ken Opara, noted that within the short period in office, Cardoso had activated notable initiatives aimed at repositioning and stabilising the Nigerian economy.

He listed the initiatives such as focusing on the core monetary policy mandate of price and exchange rate stability, unification of the exchange rate and initiating steps to boost liquidity in the foreign exchange market through commencement of settlement of mature forward obligations.

Opara said others included market reflective rate for Government Treasury Securities to ensure that investors get real positive yields on their investments, as well as joint issuance of Advisory Notice by the CBN in conjunction with the Financial Services Regulation Coordinating Committee (FSCRCC).

At the event, Nigerian Vice President Kashim Shettima and the Lagos State governor, Babajide Sanwo-Olu were represented by the Special Adviser to the President on National Economic Council (NEC) and Climate Change, Rukaiya El-Rufai and the Lagos State Commissioner for Finance, Mr Abayomi Oluyomi